How to Trade CFD instruments (Forex, Crypto, Stocks) on IQ Option

New CFD types available on the IQ Option trading platform include CFDs on stocks, Forex, CFDs on commodities and cryptocurrencies, ETFs.

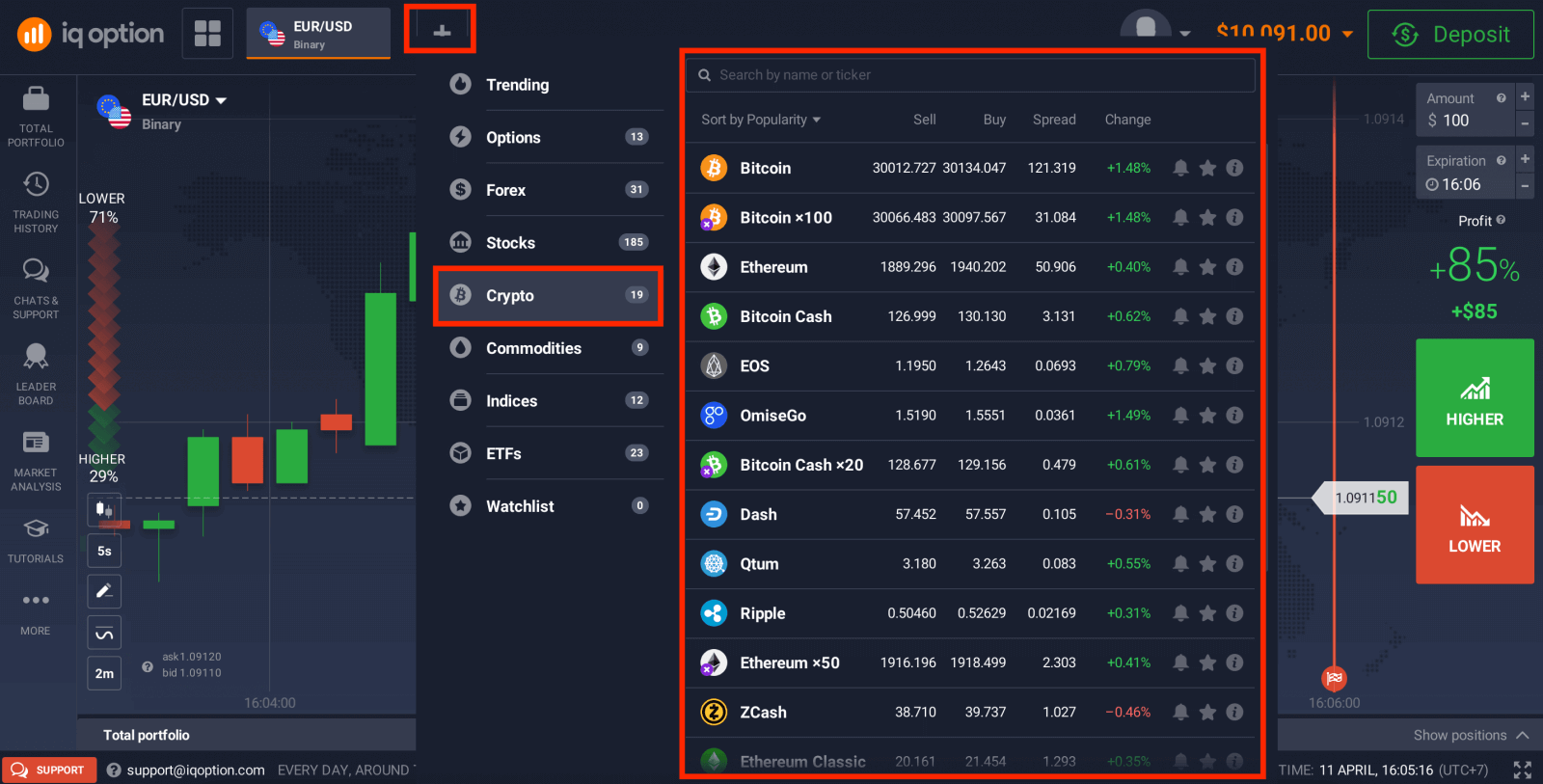

CFDs on Crypto

In the past month, cryptocurrency has made a serious leap and it seems that it is still reaching new heights. With this crypto trend, though no trend lasts forever, crypto trading is becoming more and more popular. Today we are going to learn more about trading CFDs on cryptocurrencies on the IQ Option platform.

What is Crypto?

It seems that everyone knows the names of big cryptocurrencies – Bitcoin, Ethereum, Ripple, Litecoin, and so on. Many traders have already had some experience trading these currencies, or even purchasing them to hold on a long-term basis. But what is a cryptocurrency and what is the reason for its fall or rise in value?Cryptos are digital currencies, which means that they don’t have a physical form like paper money. One main feature that most cryptocurrencies have is that they are not issued by a central authority, which, theoretically, makes them immune to any manipulation or government interference. Many cryptocurrencies are based on blockchain technology where the security of transactions is ensured by confirmations. As cryptocurrencies get accepted as a payment method, their popularity as a secure, anonymous and decentralized currency grows.

Cryptocurrency terms

As in any area, crypto trading has its own important rules and many terms that traders have to know in order to follow the market and understand the conditions well. Here are some of the most commonly used terms:Order – an order placed on the exchange to purchase or sell the cryptocurrency

Fiat – regular money, issued and supported by a state (like for example USD, EUR, GBP and so on)

Mining – processing and decrypting crypto transactions, with the purpose of getting new cryptocurrency

HODL – a misspelling of “hold” that stuck around with the meaning of purchasing cryptocurrency with the intention to keep it for a long time, with the expectation of the price growing

Satoshi – 0,00000001 BTC – the smallest part of a BTC, it can be compared to a cent in USD

Bulls – traders who believe that the price will rise and prefer to buy at a low price to sell at a higher value later

Bears – traders who believe the asset price will decrease and may possibly benefit from the asset value going down

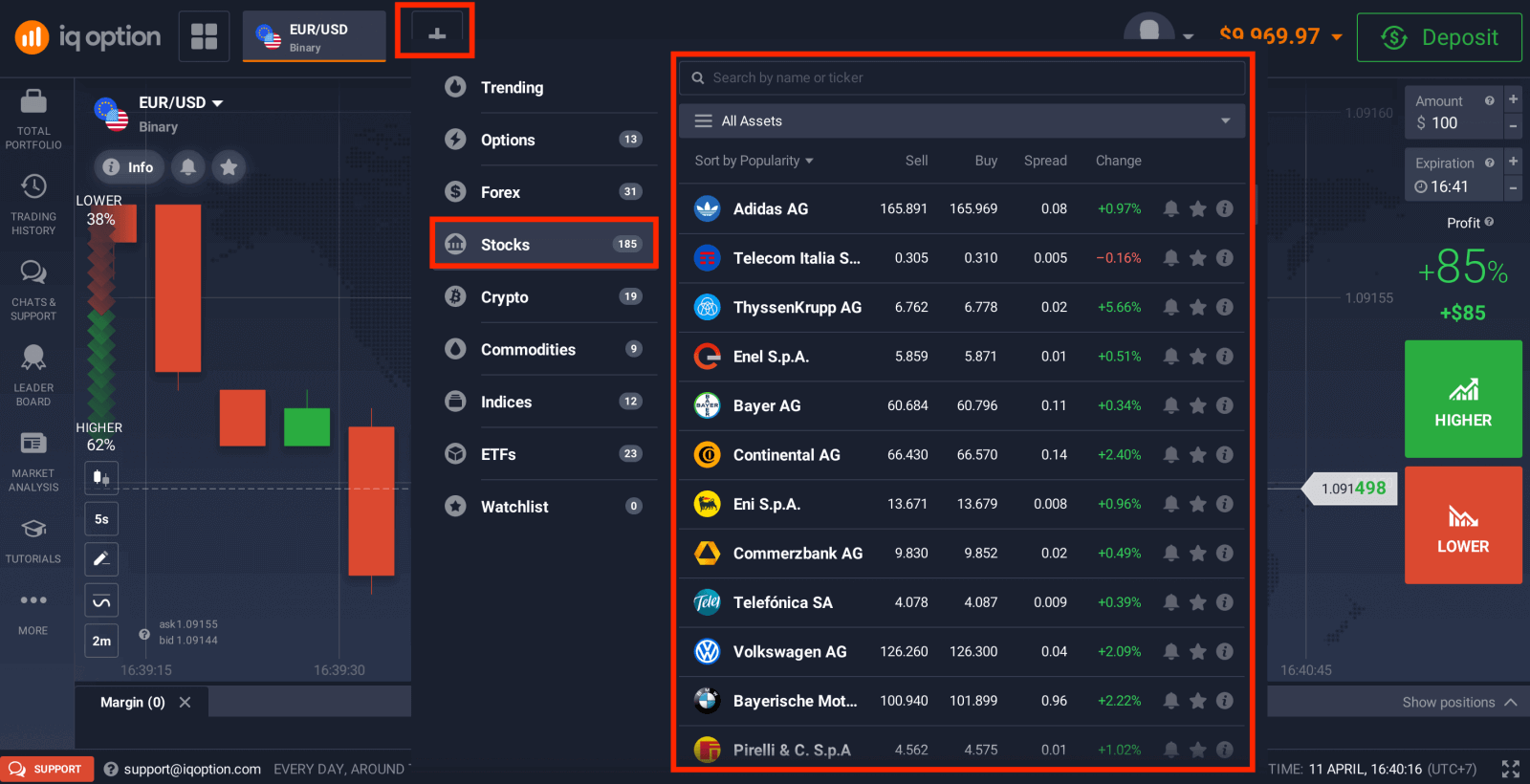

CFDs on Stocks

Traders, working with IQ Option, have the opportunity to trade shares of the world’s most renowned and powerful corporations with the help of an instrument called CFD. The three letters stand for “contract for difference”. By buying the contract, a trader does not invest his funds in the company itself. Rather, he is making a prediction regarding future price movements of the asset at hand. Should the price move in the right direction, he will receive profit proportional to the degree of the asset price change. Otherwise, his initial investment will be lost.CFDs are a good way of trading shares without turning to shares themselves. Stock trading usually involves a hassle that can be easily avoided when trading options. Stock brokers do not offer a wide range of investment instruments. On the contrary, when trading with IQ Option, you can trade equity, currency pairs, and cryptocurrencies — all in one place. The latter makes trading less time-consuming and, therefore, more effective and comfortable.

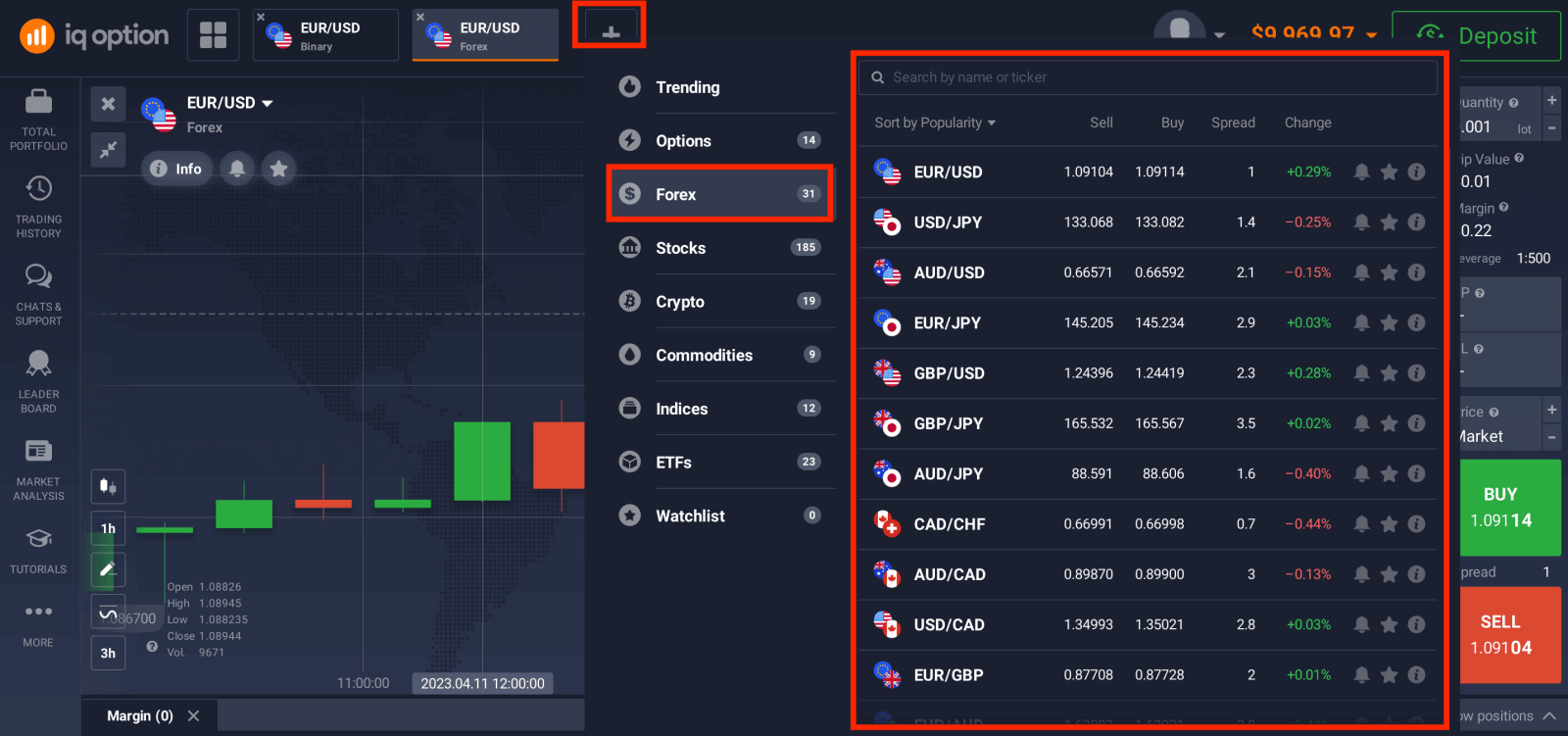

CFDs on Forex

Forex may seem complicated upon first look, however, learning its important principles of it doesn’t take a lot of time. It is a big topic, but knowing just the main concepts may allow a trader to grasp the basics of Forex trading.In this part, we will learn what Forex means, how to understand the Forex chart and what analysis tools IQ Option offers right in the trade room for the trader’s convenience.

What is Forex?

Before going into it, it is important to understand (at least in general terms) what Forex is, why it exists and why it is necessary.The term “Forex” is short for foreign exchange and it is often referred to as simply FX. The foreign exchange market is the largest and most liquid market in the world. It is decentralized: it is not just one place, but rather a system of stable economic and organizational relations between banks, brokers, and individual traders with the goal of speculation on foreign currency (buying, selling, exchanging, etc.). The reason for forming one global currency market is the developing national currency markets and their interaction.

The foreign exchange market does not set an absolute value for a currency but rather determines its relative value against another currency, this is why in Forex you will always see a pair like EUR/USD, AUD/JPY, and so on.

Understanding the chart

To understand the Forex chart, there are several main points to learn.1. Base and quote currency. The exchange rate always shows two currencies. In the pair, the first currency is called the base and the second one is the quote currency. The price of the base currency is always calculated in units of the quote currency. For instance, if the exchange rate for GBP/USD is 1.29, it means that one pound sterling costs 1.29 US dollars.

Based on that, a trader can better understand how the chart is formed. If the chart on GBP/USD, for example, is going up, it means that the price of USD depreciated against GBP. And the other way around, if the rate is going down, it means that the price of USD grows against GBP.

2. Major and exotic currency pairs. All currency pairs can be divided into major and exotic ones. Major pairs involve the major world currencies, like EUR, USD, GBP, JPY, AUD, CHF and CAD. Exotic currency pairs are those that include currencies of developing or small countries (TRY, BRL, ZAR etc.)

3. CFD. On IQ Option, Forex is traded as CFD (Contract For Difference). When a trader opens CFD, they do not own it, however, they trade on the difference between the current value and the value of the asset at the end of the contract (when the deal is closed). This allows a trader to receive his/her outcome in accordance with the difference between the entry price and the exit price.

How to trade CFDs with IQ Option?

The trader’s goal is to predict the direction of the future price movement and capitalize on the difference between the current and future prices. CFDs react just like a regular market: if the market goes in your favor, then your position is closed In-The-Money. If the market goes against you, your deal is closed Out-Of-The-Money. In CFD trading, your profit depends on the difference between the entry price and the closing price.In CFD trading, there is no expiration time, but you can use a multiplier and set stop/loss and trigger a market order if the price gets to a certain level.

Here is a step-by-step explanation of CFD trading on the IQ Option platform:

1. To begin trading on CFDs, you may open the traderoom and click the plus sign at the top to find the asset list. Find the CFDs that you are interested in.

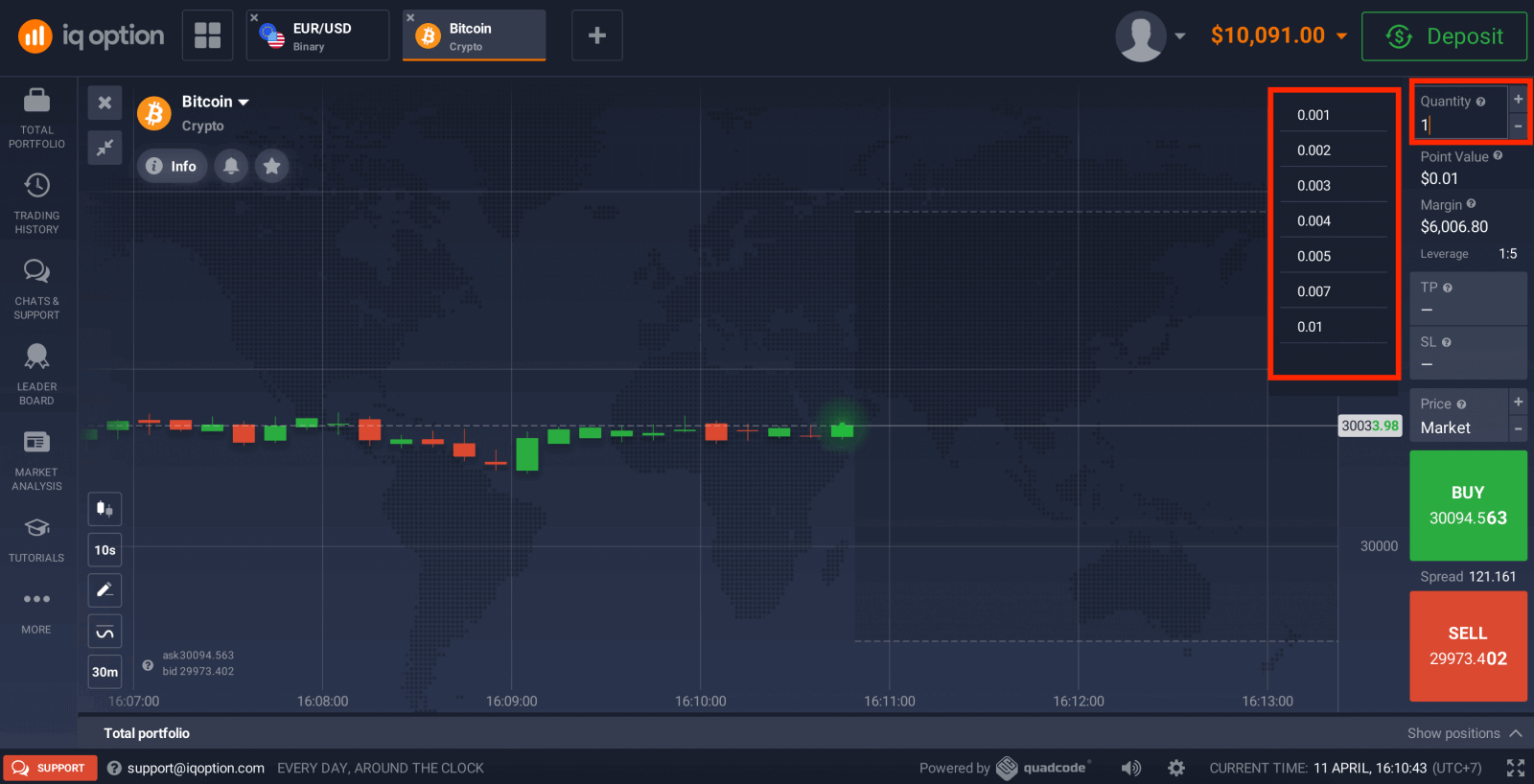

2. Choose the amount of an asset that can be bought or sold.

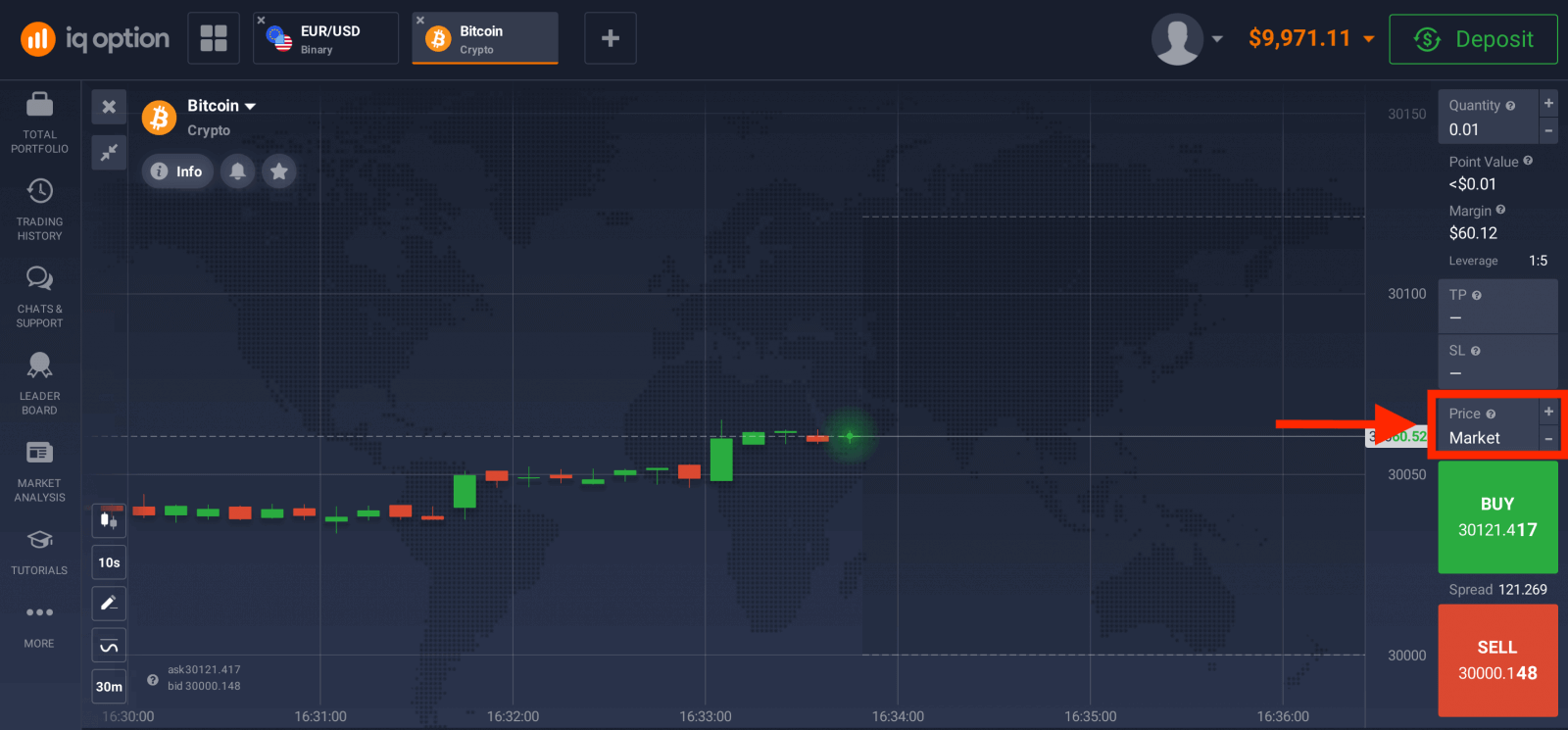

3. Choose the price.

The market price is the current price of the asset. To open a position at a certain price, please enter it in this field and place a pending order. The position will be automatically opened when the price reaches this level.

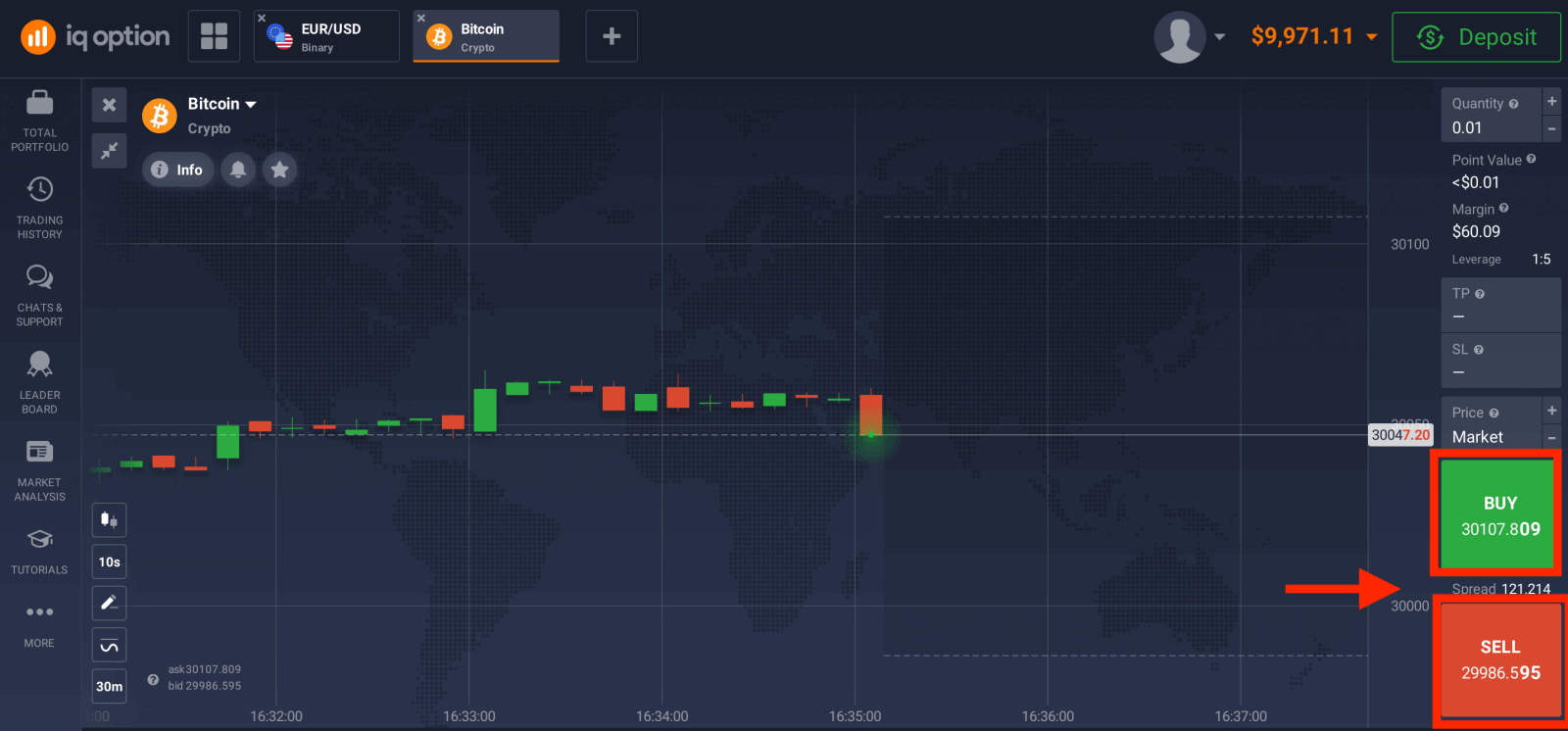

3. To open a deal, a trader will need to click the Buy or Sell button, depending on the expected price change: up or down respectively. Analyze the price chart using technical analysis tools. Don’t forget to take into account fundamental factors, as well. Then determine the trend direction and predict its future behavior in the foreseeable future.

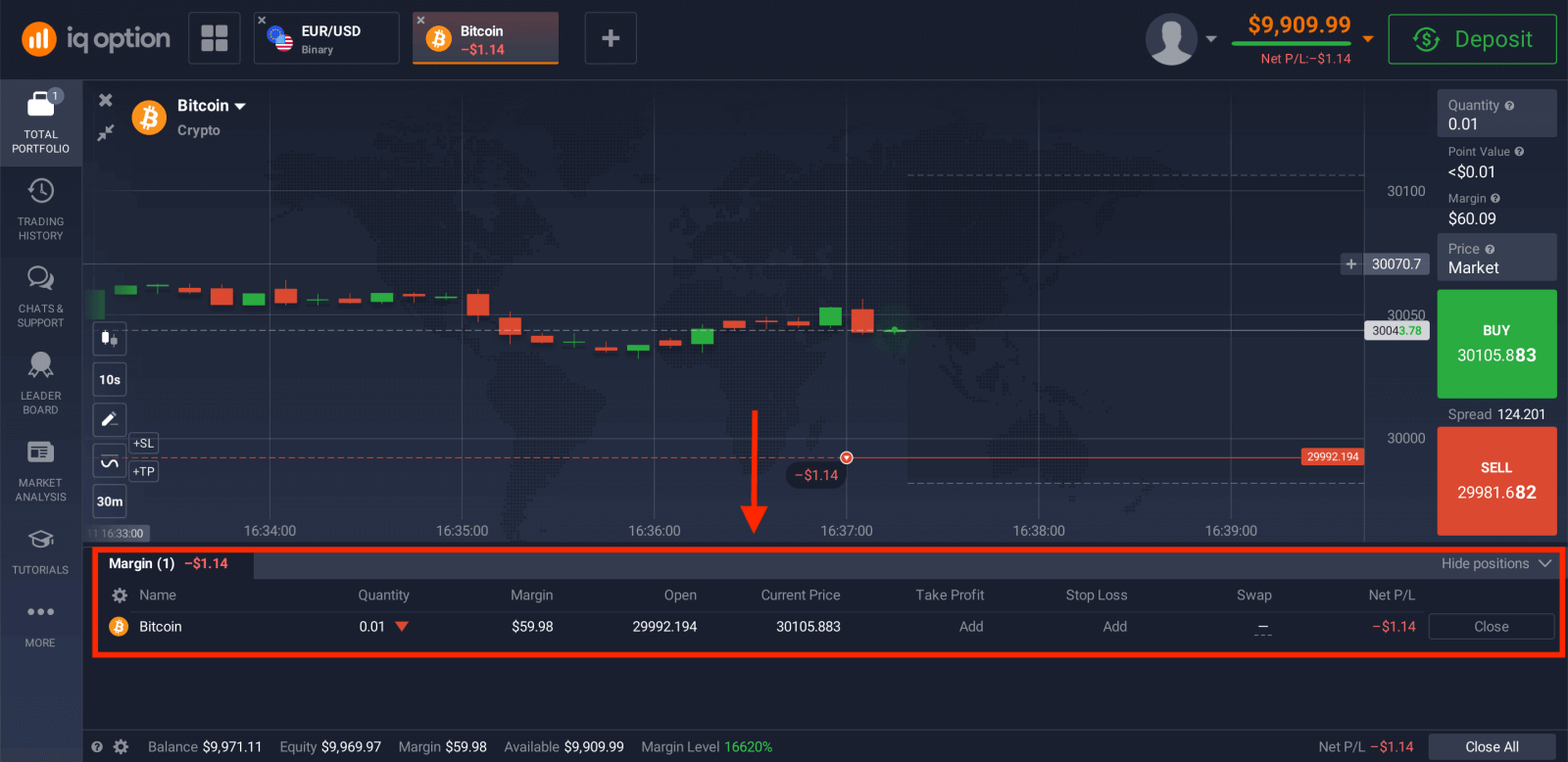

When a trader clicks one of the buttons, the details of the deal they are about to open are available. This way it is possible to double-check all of the information before confirming the deal.

CFD trading may seem easy due to the low number of variables involved. However, it is as difficult, as it could be rewarding (if done correctly). Dedicating enough time to the company you are about to trade and learning how to use technical analysis tools in advance is always better than. Dive into the engaging world of CFD trading right now.

Frequently Asked Questions (FAQ)

What is the best time to trade for trading?

The best time to trade depends on your trading strategy and some other factors. We recommend that you pay attention to the market timetable, as the overlap of the American and European trading sessions makes prices more dynamic in currency pairs such as EUR/USD. You should also keep an eye on market news which could affect the movement of your chosen asset. Inexperienced traders who don’t follow the news and don’t understand why prices fluctuate are better off not trading when prices are very dynamic.What is the minimum investment amount to open a trade?

The minimum investment amount can be found on our trading platform/website, subject to current trading conditions.

How does a multiplier work?

In CFD trading, you can use a multiplier that can help you control a position in excess of the amount of money invested in it. Thus, potential returns (as well as risks) will be increased. By investing $100, a trader can obtain returns comparable to an investment of $1,000. However, remember that the same applies to potential losses as they will also be increased several times.

How to use Auto Close settings?

Stop Loss is an order that the trader sets to limit losses for a particular open position. Take Profit works in much the same way, allowing the trader to lock in a profit when a certain price level is reached. You can set the parameters as a percentage, amount of money or asset price.

How to calculate profit in СFD trading?

If the trader opens a long position, the profit is calculated using the formula: (Closing price / Opening price - 1) x multiplier x investment. If the trader opens a short position, the profit is calculated using the formula (1 - Closing price / Opening price) x multiplier x investment.For example, AUD / JPY (Short position): Closing price: 85.142 Opening price: 85.173 Multiplier: 2000 Investment: $2500 The profit is (1 - 85.142 / 85.173) X 2000 X $2500 = $1.819.82

What is OTC?

Over-the-counter (OTC) is a trading method that is available when the markets are closed. When trading OTC assets, you get quotes that are generated automatically on the broker’s server in a way that maintains equilibrium between buyers and sellers.Every Friday at 21:00 and every Monday at 00:00 am (GMT time) IQ Option is switching from market trading to OTC trading and from OTC trading to market trading.